Update! October 4th, 2022

As per latest Instruction from the Canadian Excise Tax Office, we are able to sell our existing stock until December 31, 2022 at no additional tax, once current stock runs out, all new product will be subject to excise tax collection as per translation table shown below.

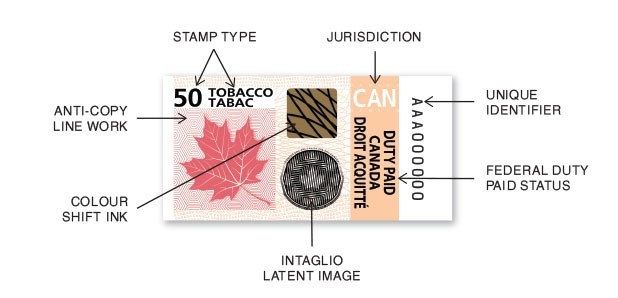

An excise duty on vaping products, as announced in Budget 2022, is being implemented on October 1, 2022 through the introduction of a new excise duty framework. The excise duty applies to vaping substances that are manufactured in Canada or imported and that are intended for use in a vaping device in Canada.

What is it and how it will affect you?

The Canadian government is introducing an excise duty that will require all e-liquid or pre-filled pod / cartridge sold in Canada to be excise-tax stamped (similar to the excise stickers found on tobacco and cannabis products).

How to calculate:

The excise duty rates on vaping products are outlined in Schedule 8 of the Excise Act, 2001 and are as follows:

For vaping liquids:

- $1 per 2 millilitres (mL), or fraction thereof, for the first 10 mL of vaping substance in the vaping device or immediate container

- $1 per 10 mL, or fraction thereof, for amounts over the first 10 mL

How it translates to ePuffer products?

| Product | Excise Tax Rate From Oct 1, 2022 |

|---|---|

| 30mL Eliquid Bottle | + $7.00 |

| 50mL Eliquid Bottle | + $9.00 |

| XPOD 3-Pack | + $3.00 |

| ECO Disposable E-Cigarette | + $1.00 |

| ROBUSTO Disposable E-Cigar | + $1.00 |

| SNAPS Cartridges 5-Pack | + $5.00 |

What products are affected?

This only affects e-liquid or anything that contains e-liquid for example: disposable e-cigarettes, e-cigars, pre-filled pod and cartridge systems).

This does not affect any Vape Hardware ( non-filled, refillable devices sold without eliquid).

Is it still cheaper to Vape?

100% Yes! Even after paying the Excise Tax you will still save compare to smoking.

For example, one pack a day smoker will spend ~$119.00 on cigarettes a week, vs. $41.86 on prefilled XPOD, or $22.95 for a bottle of 30ml eliquid in the same one-week period.